SoFi Technologies (SOFI) has evolved into a full-fledged digital financial platform, offering everything from banking to investing. This past week, the company grabbed headlines with blowout second-quarter earnings, raised full-year guidance, and clear signs that it is chipping away at legacy banks’ market share.

The post-earnings surge was followed by a dip on news of a $1.5 billion public share offering. However, SOFI stock has regained its footing, still above the $21 level seen before the July 29 earnings release.

With strong revenue acceleration, improving profitability, and a capital-light model gaining traction, SoFi’s core engine looks well-tuned. Still, with its high valuation and a few skeptics on Wall Street, investors are left wondering — especially after this wild week — whether it's too late to grab SOFI stock.

About SoFi Stock

Founded in 2011, San Francisco-based SoFi is rewriting the personal finance playbook with sleek technology and bold execution. With more than 11 million members, it spans lending, financial services, and a robust tech platform across the U.S. and beyond. SoFi’s all-in-one digital ecosystem is shaking up legacy banking, proving that fintech is already here. Its market capitalization currently stands at $23.5 billion.

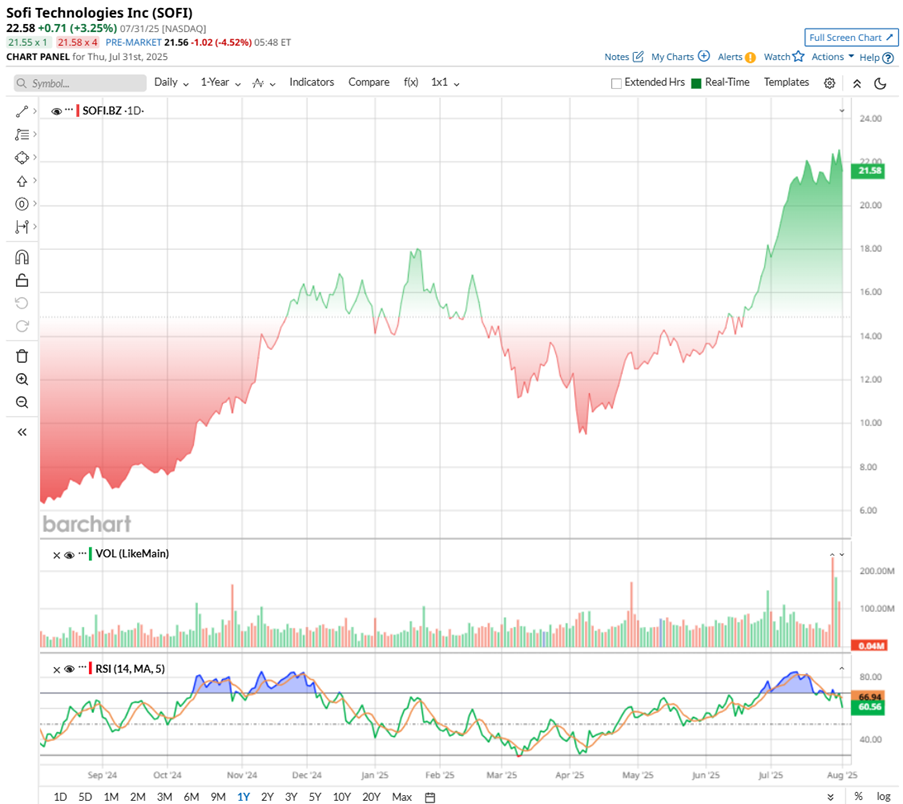

SOFI stock has surged 197% over the past 52 weeks and risen 70% in the last three months, breaking out to a new 52-week high of $25.11 on July 29 following strong Q2 results and raised guidance. That said, the rally paused after a $1.5 billion equity offering triggered dilution concerns.

Technically, volume remains elevated, and RSI has pulled back from overbought levels, signaling a possible consolidation phase within a still-intact bullish trend structure.

www.barchart.com

www.barchart.comSoFi’s overall rally is hard to ignore, but its price tag is not for the faint-hearted. Trading at 71 times forward earnings and 9.3 times sales, it is well above that of the legacy banks. That’s premium pricing, no question. But SoFi is not chasing old-school playbooks — it is scaling fast, stacking users, and rewriting the digital finance script. Sure, it's expensive. But if investors are betting on the future of fintech, the recent dip could be their shot before the next leg higher.

SoFi's Record Q2 Results and Sharper Outlook

On July 29, SoFi delivered a Q2 report that didn’t just beat expectations, but smashed them. The company posted adjusted revenue of $858.2 million, up 44% year-over-year (YOY), while adjusted net income rocketed 459% to $97.3 million. Adjusted EPS came in at $0.08, a sevenfold increase from the $0.01 reported a year ago.

The growth was not limited to the top and bottom lines. SoFi added 850,000 new members, pushing its total to 11.7 million, and also racked up 1.26 million new products, bringing the tally to 17.1 million. Both of these figures rose 34% YOY. Fee-based revenue jumped 72% to $377.5 million, led by SoFi’s Loan Platform Business, which originated $2.4 billion in third-party loans and pulled in $130.6 million in revenue on its own.

Lending was a clear standout. The company funded a record $8.8 billion in loans, including personal loan originations which rose 66% annually, student loans which grew 35%, and home lending which soared 92%. On the tech side, SoFi's Galileo and Apex platforms brought in nearly $110 million, up 15%, while SoFi also stepped back into crypto and teased new AI-driven initiatives aimed at improving operational efficiency and member experience.

Fueled by the blowout quarter, SoFi raised its full-year 2025 outlook. Management now expects adjusted net revenue of $3.375 billion, up from the previous guidance range of $3.235 billion to $3.31 billion. That implies 30% annual growth. Adjusted EBITDA is projected at $960 million as well, up from a prior $875 million to $895 million range, with margins climbing to 28%. Net income is now forecast at $370 million, and full-year EPS is guided to be $0.31, both topping earlier estimates.

Wall Street seems aligned with these expectations. Analysts believe SoFi will post 2025 EPS of $0.32, marking 113% annual growth, with another 75% lift to $0.56 expected in 2026. If SoFi can stay the course, it's setting up for a potential breakout year.

What Do Analysts Expect for SoFi Stock?

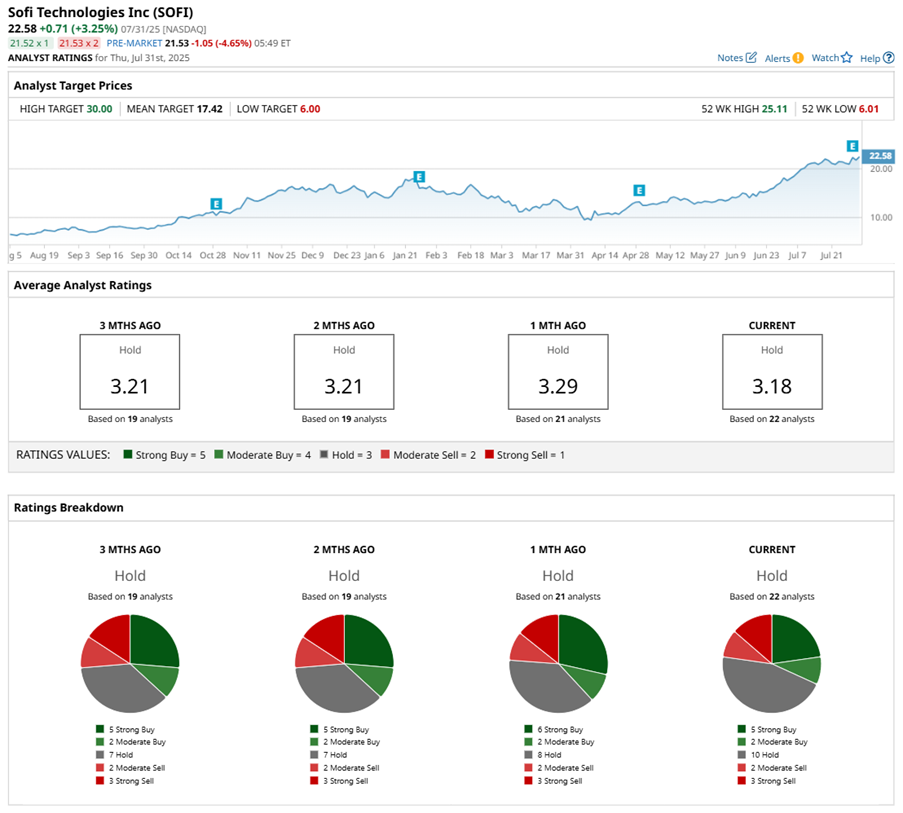

Wall Street’s outlook on SoFi after Q2 earnings is a mix of optimism and caution. Jefferies analyst John Hecht remains firmly in the bullish camp, having lifted his price target to $27 with a “Buy” rating. Hecht sees SoFi’s beat-and-raise quarter as reflecting momentum that could carry through to year-end.

Meanwhile, Mizuho has doubled down on SoFi, boosting the price target to $26 from $20 and reaffirming an “Outperform” rating. The firm praised SoFi’s “very strong” Q2 across all key metrics, spotlighting $9.5 billion in annualized lending volume and 90% growth in home lending as major strengths, especially in a weak housing market. Mizuho also bumped its 2025 revenue forecast to $3.4 billion and adjusted EBITDA forecast to $965 million.

Still, others are pumping the brakes. BTIG kept a “Hold" on SOFI stock, noting that the recent rally might already reflect most of the good news. BTIG acknowledged upside in SoFi’s crypto and investment products, but questioned its ability to scale fast enough to seriously rival players like Robinhood (HOOD).

TD Cowen analyst Moshe Orenbuch echoed that caution, keeping a “Hold” and $22 target. The analyst praised SoFi’s platform momentum and strategic partnerships but warned of slower growth ahead.

Despite SoFi’s Q2 blowout, not everyone on Wall Street is buying the hype. SOFI stock has an overall consensus “Hold” rating. Out of 23 analysts covering the fintech stock, only five advise a “Strong Buy” rating and two recommend a “Moderate Buy.” Meanwhile, 11 analysts play it safe with a “Hold,” two mark SOFI as a “Moderate Sell,” and three recommend a “Strong Sell" rating.

SoFi is showing no signs of slowing down and has already surged past the average analyst price target of $18.52.

www.barchart.com

On the date of publication,

Sristi Suman Jayaswal

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

www.barchart.com

On the date of publication,

Sristi Suman Jayaswal

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.