Bank of America Corporation (BAC), headquartered in Charlotte, North Carolina, offers a range of banking and financial products and services. With a market cap of $343.9 billion, the company offers savings accounts, deposits, mortgage and construction loans, cash and wealth management, certificates of deposit, investment funds, credit and debit cards, insurance, mobile, and online banking services.

Shares of this banking giant have outperformed the broader market over the past year. BAC has gained 15.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.5%. However, in 2025, BAC’s stock rose 3.9%, compared to the SPX’s 6.1% rise on a YTD basis.

Zooming in further, BAC’s outperformance looks more pronounced compared to SPDR S&P Bank ETF (KBE). The exchange-traded fund has gained about 6.9% over the past year. Moreover, BAC’s single-digit gains on a YTD basis outshine the ETF’s marginal dip over the same time frame.

www.barchart.com

www.barchart.com

Bank of America's outperformance is driven by its strategic focus on organic growth, digital expansion, and strengthening customer relationships. With plans to open over 150 new financial centers and leveraging tools like Zelle and AI assistant Erica, BAC is poised for growth. A strong investment banking pipeline also positions the bank for a rebound in global deal-making activity, supported by its expansive scale and digital leadership.

On Jul. 16, BAC shares closed down marginally after reporting its Q2 results. Its EPS of $0.89 surpassed Wall Street's expectations of $0.86. The company’s revenue was $26.5 billion, falling short of Wall Street forecasts of $26.6 billion.

For the current fiscal year, ending in December, analysts expect BAC’s EPS to grow 11.9% to $3.67 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

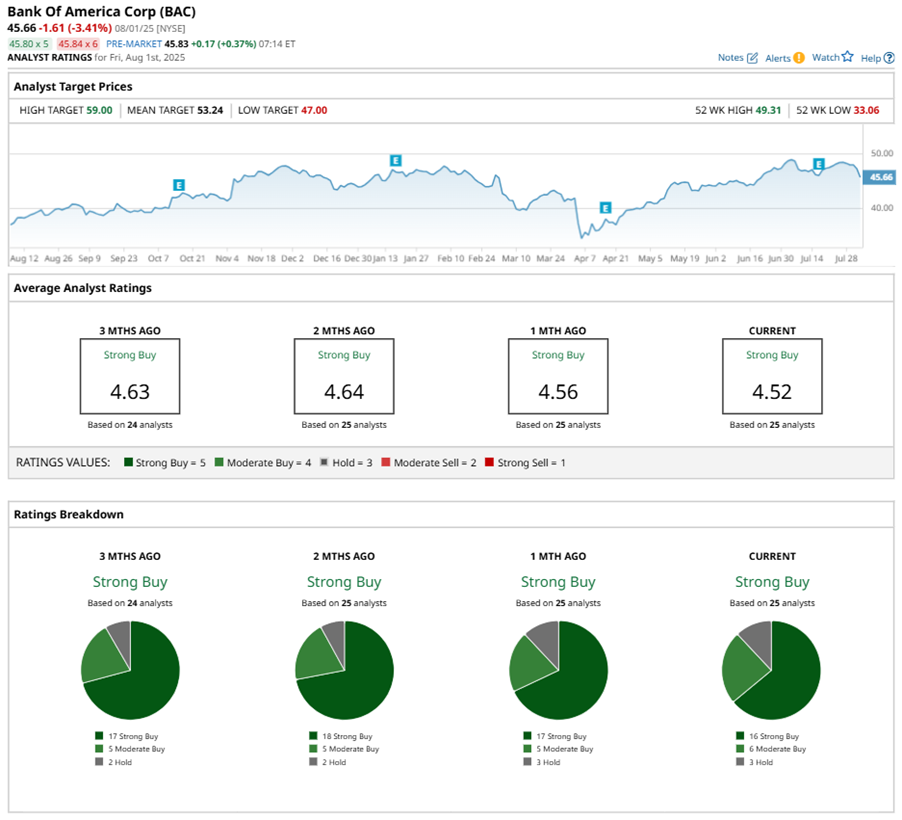

Among the 25 analysts covering BAC stock, the consensus is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, six “Moderate Buys,” and three “Holds.”

www.barchart.com

www.barchart.com

This configuration is less bullish than a month ago, with 17 analysts suggesting a “Strong Buy,” and five analysts recommending a “Moderate Buy.”

On Aug. 1, Jason Goldberg from Barclays PLC (BCS) maintained a “Buy” rating on BAC with a price target of $54, implying a potential upside of 18.3% from current levels.

The mean price target of $53.24 represents a 16.6% premium to BAC’s current price levels. The Street-high price target of $59 suggests a notable upside potential of 29.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.